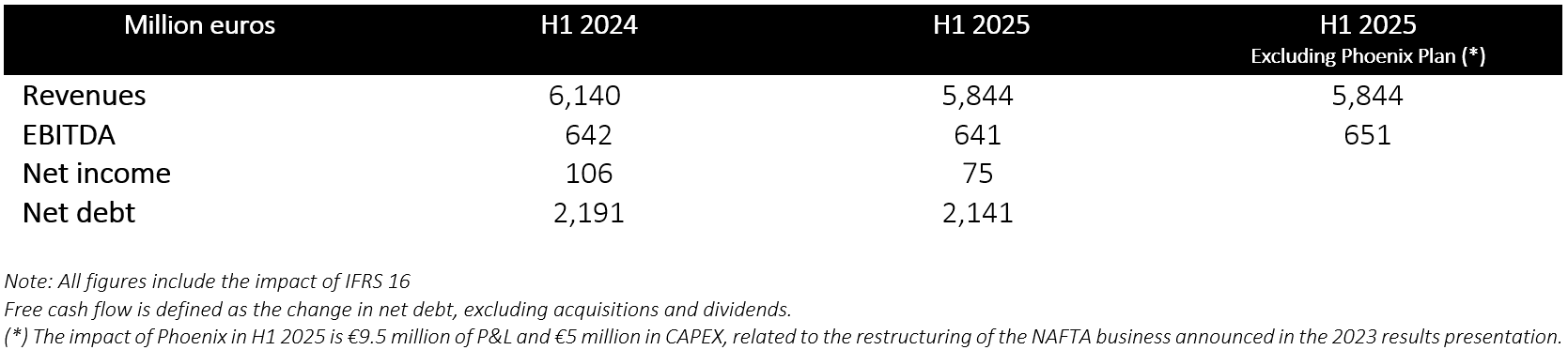

Gestamp, the multinational specialized in the design, development and manufacture of highly engineered metal components for the automotive industry, presented today its results for the first half of 2025. During the period, and despite the negative currency impacts and the volatility in some of its key markets, Gestamp has improved its profitability in the second quarter and reduced its net debt to €2,141 million, the lowest level achieved by the company in the first half of the year since the implementation of IFRS 16.

Francisco J. Riberas, Executive Chairman of Gestamp: “In a particularly challenging environment for the sector, our focus remains on preserving our leading position within an industry undergoing a fast and in-depth transformation, while reinforcing the strength of our balance sheet and improving profitability. The efficiency and cost control measures are reflected in the results achieved, and with a strong free cash flow generation in the semester, we consolidate a strong financial profile”.

Solid execution in a volatile environment

In the first half of the year, light vehicle production volumes grew by 3.7% year-on-year, driven mainly by Asia, despite a significant decrease in Europe and NAFTA.

In the second quarter of the year, Gestamp generated positive cash flow of €182 million, closing the first half of the year with a total €99 million of positive free cash flow (excluding Phoenix Plan impact). Due to this, Gestamp continues its trend of strengthening its balance sheet and reducing leverage, with net debt standing at €2,141 million in the first half of the year compared to €2,191 million in the same period of 2024, which represents a leverage of 1.7x net debt to EBITDA, the lowest nominal net debt achieved by the company in the first half of the year since the application of IFRS 16.

These results have been achieved despite an unprecedented transformation of the automotive industry and short-term volatility in some of Gestamp’s key markets, leading the multinational to close the first half of the year with revenues of €5,844 million. This performance was affected by the decline in light vehicle production in key markets such as Western Europe and NAFTA, as well as by negative currency impacts.

Despite the context, Gestamp continues to preserve and improve profitability by implementing short-term initiatives, including flexibility measures and a cost control plan to ensure efficiency. EBITDA in the second quarter amounted to €343 million (excluding Phoenix Plan impact) and an EBITDA margin of 12%, the company’s second-best first-half result since its IPO.

Phoenix Plan in NAFTA: a strategic priority

One of the company’s main priorities remains the execution of the Phoenix Plan in NAFTA. Despite the decrease in light vehicle production volumes in the region, the plan develops as foreseen, with an EBITDA margin of 7.1% at the end of the first half of the year (excluding Phoenix Plan impact).

The company’s strategic priority is to achieve an EBITDA margin of approximately 8% by the end of 2025. The plan is in line with its objective of increasing profitability in this market to the same levels as in the rest of the regions where the company is present.

Gestamp reiterates its guidance for 2025

Despite a context of high uncertainty and limited market growth, the results achieved by Gestamp in the first half of the year allow the company to reiterate its commitment to meet the guidance set for 2025. The multinational retains its aim to maintain the profitability of the automotive business in line with the results obtained at the end of 2024 and to generate a free cash flow in line with 2024.

Partnership with Santander Bank to reinforce balance sheet

In line with the company's strategy to strengthen its balance sheet, Gestamp and Santander Bank have signed an agreement today, under which the bank, through Andromeda Principal Investments, S.L.U, will take a minority stake in the share capital of four Group companies, which hold Gestamp’s Spanish real estate assets.

During the month of September, upon the closing of the agreement, the Bank will invest €245.5 million to acquire the stake. The transaction will be executed through the subscription of a capital increase in each company and the issuance of preferred shares.

It is important to note that Gestamp will keep full control of the assets for the operation of its industrial activity in Spain.

This agreement aligns with the company's strategic objectives, which focus on strengthening the balance sheet profile and crystalizing value from Gestamp’s real estate assets. The direct impact of the operation will be the reduction of the net debt, which would represent a leverage of 1.5x net debt to EBITDA Pro Forma for June 2025, in line with the commitment acquired in the Capital Market Days hold in 2023.

In words of Francisco J. Riberas, Executive Chairman: “This transaction represents a key milestone in strengthening our financial profile. In a volatile and uncertain macroeconomic environment, we are reinforcing our financial position that will enable the company to maintain our technological and geographic leadership, boost our strategy of profitable growth, and continue to move forward with a long-term vision and confidence in the future”.